If you have a health insurance plan, or you’re in the market for insurance, you may be feeling a bit overwhelmed, and maybe confused by all the terms being used, copay, deductibles ,premiums, co-insurance, individual out-of-pocket maximum. Add the fact that many of these can vary widely based on the coverage or plan, and you’ve got a lot to wrap your mind around. In this article, we’re going to break down and demystify these essential health insurance terms, explain how the costs work for both you and your insurance company, and hopefully make you feel a bit more confident about how your plan works. So let’s get started.

Sort of the view from 10,000 feet is that there are three levels of healthcare costs, and the higher your costs for the year, the higher up you go, level one, level two, level three.

On level one, you pay for everything. When your healthcare expenses get to a certain point, you enter level two, where you and your insurance company share the costs. And if the money you’re paying out of pocket hits your plans cap, then you enter a level three, where your insurance will cover everything further. We’ll circle back to this at the end. It’ll all make a little more sense.

Now, whether your health insurance is provided through your employer plan, through somebody else’s employer plan, or a government-issued plan like Medicare or Medicaid, they all have a set amount for premiums, deductibles, copay, and co-insurance. These are all terms that represent your out-of-pocket costs. If you don’t know what those figures are for your policy, contact your insurance company to request a copy of your policy. Now, I just throw a bunch of terms at you.

Let’s define these terms

Premium, think of your premium like a monthly subscription fee, like your Netflix subscription. This is how much you pay each month to keep your insurance active. And you pay this even if you never go to the doctor. Just like with Netflix, even if you don’t watch anything, you’re still paying your subscription, right?

Deductible, your deductible is amount specified by your plan that you have to pay in a given year before your insurance pays a dime. For example, if your deductible is set at $4,000, and the bill for your visit to the hospital was $2,000, you have to pay a 100%of that bill,. But if your deductible is set at $4,000 and the hospital bill is $8,000, insurance would kick in to help cover half of that bill. Notice that I said it will help. More on that later. The good news is that this is an annual deductible, meaning that once you’ve paid that amount towards covered medical expenses, you don’t have to pay it again until your plan resets. Often, this is on January 1st, but that’s not always the case. You should check with your insurance provider. When shopping for health insurance, it’s great to look for a plan with a low deductible. However, there is of course a trade-off. Plans that feature a low deductible come with higher monthly premiums, while plans with lower monthly premiums have high deductibles. So why choose one over the other? Well, it comes down to what you anticipate your usage will be. If you usually go for one, maybe two doctor’s visits per year, you probably want it high deductible with low premiums. These are often referred to as catastrophic coverage plans, because they aren’t going to kick in until something really significant ,or catastrophic happens. On the other hand, if you visit the hospital a lot, or you have some upcoming procedures, then you probably wanna go with a high premium, low deductible plan. If you have a health insurance usage history, you can use that to help determine which kind of plan is gonna be best for you.

Copay, your copay is a set cost that you pay for a covered healthcare service, such as visiting an in-network doctor, a specialist, or buying drugs. Let’s say you go to see your doctor who charges $250 for an office visit. But your insurance has a copay of $50 for doctor’s visits. You pay $50, and your insurance picks up the rest. Well, hold on a second. How do copays work if I haven’t met my deductible yet? Because copays are paying for some of your medical expenses. Doesn’t that not kick in until after you hit your deductible? Well, confusingly, it depends on your policy. So that’s something you really wanna check on. Here’s a tip, your insurance will likely have a list of preventative care benefits that they’ll cover at 100%, no copay, no deductible, no co-insurance. These often include vaccines and many types of screenings, so take advantage of those. Co-insurance, remember when I said that insurance would help cover costs that exceed your deductible? That’s where co-insurance comes in.

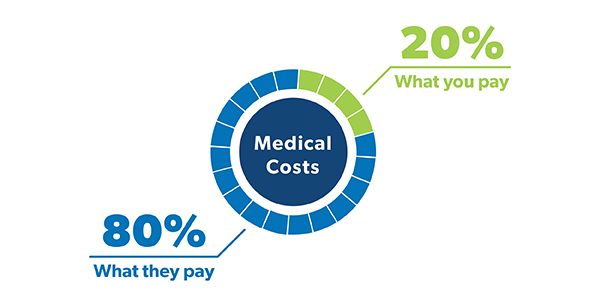

Co-insurance is a shared cost between you and the insurance company. So depending on your policy, it may say that after your deductible, you pay 20% and your insurance company pays 80%. That’s called an 80/20 policy. Now, for the ease of math, let’s say you have a 50/50 policy with a $4,000 deductible, and you just had an $8,000 ER visit. You pay the first $4,000to meet your deductible, and then the second $4,000would be split 50/50, meaning you’d pay 2,000 of that. So for that $8,000 ER visit, you’d be out $6,000.

Individual out-of-pocket maximum, out of pocket is the amount of money that you pay. This includes your copays, doctor’s visits, co-insurance, deductibles, drugs, and the out-of-pocket maximum is your plan’s cap on how much you have to personally pay towards your healthcare costs. After you hit that maximum, 100% is covered by your insurance.

Family out-of-pocket max, based on what individual yearly out-of-pocket is, you can probably guess this one. It’s the cap on the medical costs for a whole family.

Now, let’s bring back the three levels example from the beginning. Now, you start in level one, paying basically everything out of pocket, that is, until you reach your deductible, and that’s when you go to level two, and that’s where you’re splitting the cost with your insurance company through co-insurance. If your medical expenses get so high that the total of what you paid reaches your yearly out-of-pocket maximum, you move to level three, where all further healthcare expenses for the rest of the year are 100% covered by your insurance plan. When your plan resets for the year, you start back at the beginning. Usually, this happens on January 1st, but some plans differ on their reset date.

If you’re still feeling unsure about what this all means, or about your financial responsibility for your covered services, your local healthcare facility can often help you obtain and understand this information, especially when considering an upcoming service or appointment. Hopefully, this article has helped you feel a little more comfortable with the costs involved in your health insurance.

- Webinar on World Hand Hygiene | Register today

- World’s First 5-in-1 vaccine against meningitis | Men5CV

- World Health Worker Week 2024 | Know theme

- World Autism Awareness Day 2024 | Know theme

- Staff Nurse | OCH | latest jobs vacancy 2024

- World Hepatitis Summit 2024 | WHO

- Staff Nurse | TLMN | ngo jobs 2024

- World Health Day 2024 | Know theme

- Measuring access to assistive technology in Nepal | Country Report

- Migration Health Nurse | IOM | ingo jobs

- Nursing Officer | Kopila Valley | nursing jobs 2024

- Benefits and risks of using artificial intelligence for pharmaceutical development and delivery | WHO

bachelor jobs bph jobs covid19 health health for all health guidelines new health jobs healthjobs healthjobs in nepal health jobs vacancy health public health update ingo jobs jobs after passing bachelor jobs for bph jobs in nepal jobs in ngo ngo jobs ngo jobs vacancy ngo jobs vacancy for bph ngo job vacancy 2021 nurse jobs nurse jobs 2021 nurse vacancy nursing insurance nursing job nursing jobs nursing jobs 2021 nursing jobs in nepal nursing law nursing officer Nursing Vacancy Public health Public health concern public health important days Public health in Nepal publichealth jobs public health updated Staff Nurse Staff Nurse and HA Vacancy | Nepal Army 2021 staff nurse vacancy staff nurse vacancy in ngo 2021 nepal staff nurse vacancy kathmandu who guidelines WHO official

Hey there, I am Nirdesh Baral, founder of Nepal Health Magazine. I am a Tech geek by passion , Public health practitioner by profession and an Ailurophile by heart and a patriot by birth